The coronavirus shutdowns have had a dramatic impact on the broader economy (if not the stock market, which is almost back to all time highs) and few have been hit as hard as young Americans such as Millennials and Gen Zers. A recent survey from Travis Credit Union seeking to learn more about the money-saving habits of young Americans and how Covid-19 and the looming recession has impacted their savings, polled nearly 2,000 Millennials and Gen-Zers and here’s what they found:

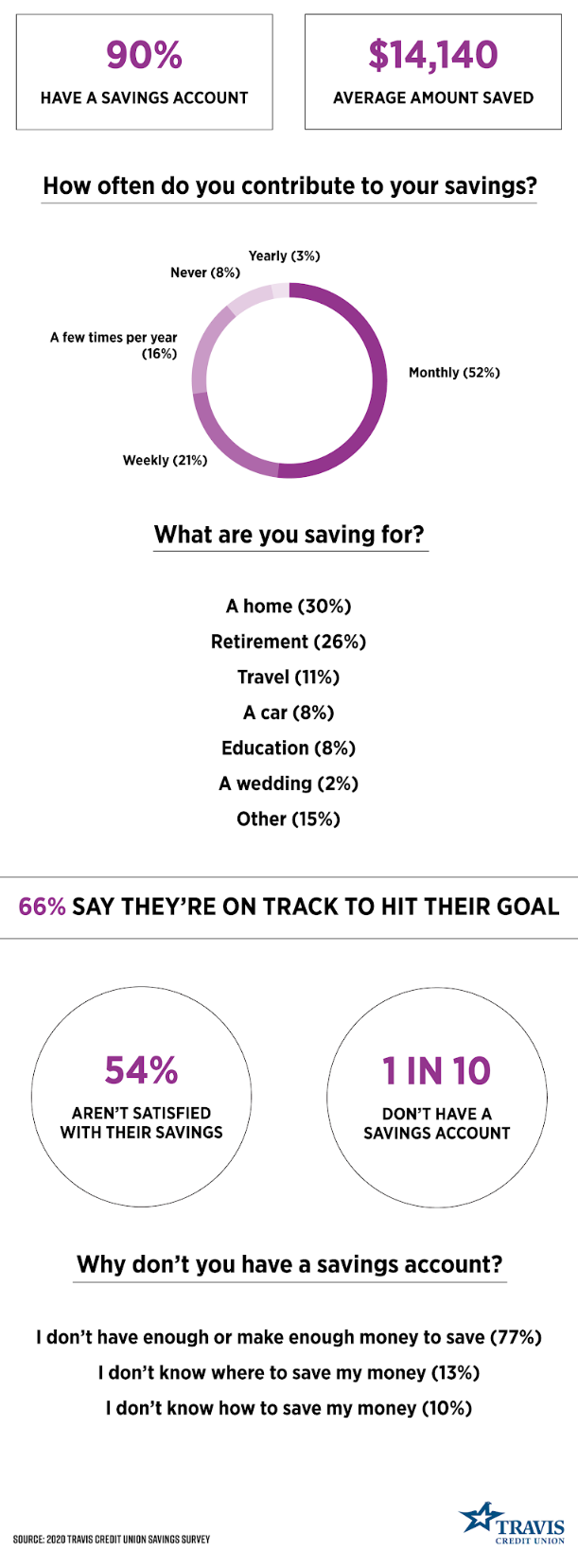

- 99% said that saving money is important to them.

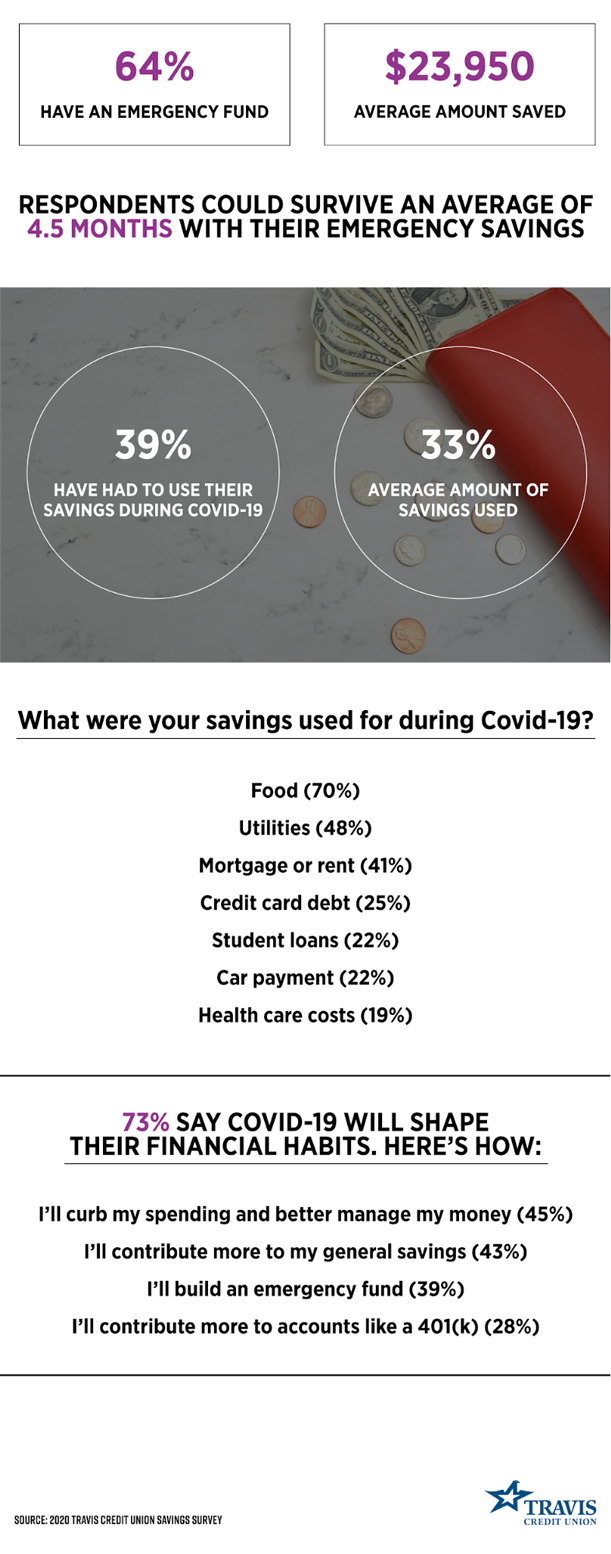

- 39% of young Americans have had to dip into their savings during Covid-19 and have used an average of one-third of their total savings

- The top reasons for using savings during Covid-19: Food, utilities, mortgage or rent, credit card debt, and student loans.

- 73% of respondents said Covid-19 will shape their financial habits moving forward.

Some more details: on average, respondents began saving at the age of 19 and 90% have taken the first step and opened a dedicated savings account. While men have more saved than women on average ($16,631 and $11,649, respectively), over half of all respondents add to their savings on a monthly basis.

Looking into the future, 1 in 4 young Americans say that the most important thing they’re planning for is retirement, with just over half saying they have a savings account dedicated to their retirement goals. The most popular type of retirement account: 401(k) (34%), followed by a Roth IRA (20%) and separate personal savings account (20%).

Even with good saving habits in place, 8 out of 10 respondents said that they’ve felt stress or anxiety when it comes to saving money. That’s no surprise, given the current economic climate – but they’ve learned to plan for times like these. In addition to a nest egg, 2 in 5 have and work to maintain an emergency fund. When asked what they are preparing for, many said potential job loss (33%), while others cited family emergencies (32%), medical emergencies (27%), and major home or car repair (8%).

As the survey concludes, in the face of the Covid-19 pandemic and an economic recession, Millennials and Gen Zers are learning the importance of having these funds tucked away for a rainy day. Three out of four say that the impact of coronavirus has changed their saving habits and that it will continue to shape their financial habits going forward.

This is not the first time a crisis has changed young adults’ relationship with money. Many point to the 2008 economic recession as a financial influence, and one in three say it changed how they approach their saving habits. When asked, 42% said they began saving sooner, 21% became more aware of their spending, 19% began saving for retirement earlier than planned, and 18% pursued a career with job security.

Of course, no matter how optimistic of a spin the poll creators want to put on it, if a third of young America’s savings has indeed already been wiped out, that means that a tremendous amount of future purchasing has been pulled into the future. And in an economy that has been notoriously hostile to young workers, it is unclear just how or where all these Millennials and GenZers will find the funds to replenish their savings funds. Worse, it also means that if four months of living under the pandemic is all it took for a third of their savings to be gone forever, we dread to think what will happen in 8 months if there is still no vaccine or cure, and the economy is still barely functioning as it is today.