Back on Monday, when analysts and investors were desperately seeking clues whether China has managed to reboot its economy from the 2-week long hiatus following the Lunar New Year/Coronavirus pandemic amid the information blackout unleashed by the communist party in the already opaque country, we pointed out some alternative ways to keep tabs of what is really taking place “on the ground” in China, where Xi Jinping has been urging local businesses and workers to reopen and resume output, while ignoring the risk the viral pandemic poses to them (with potentially catastrophic consequences).

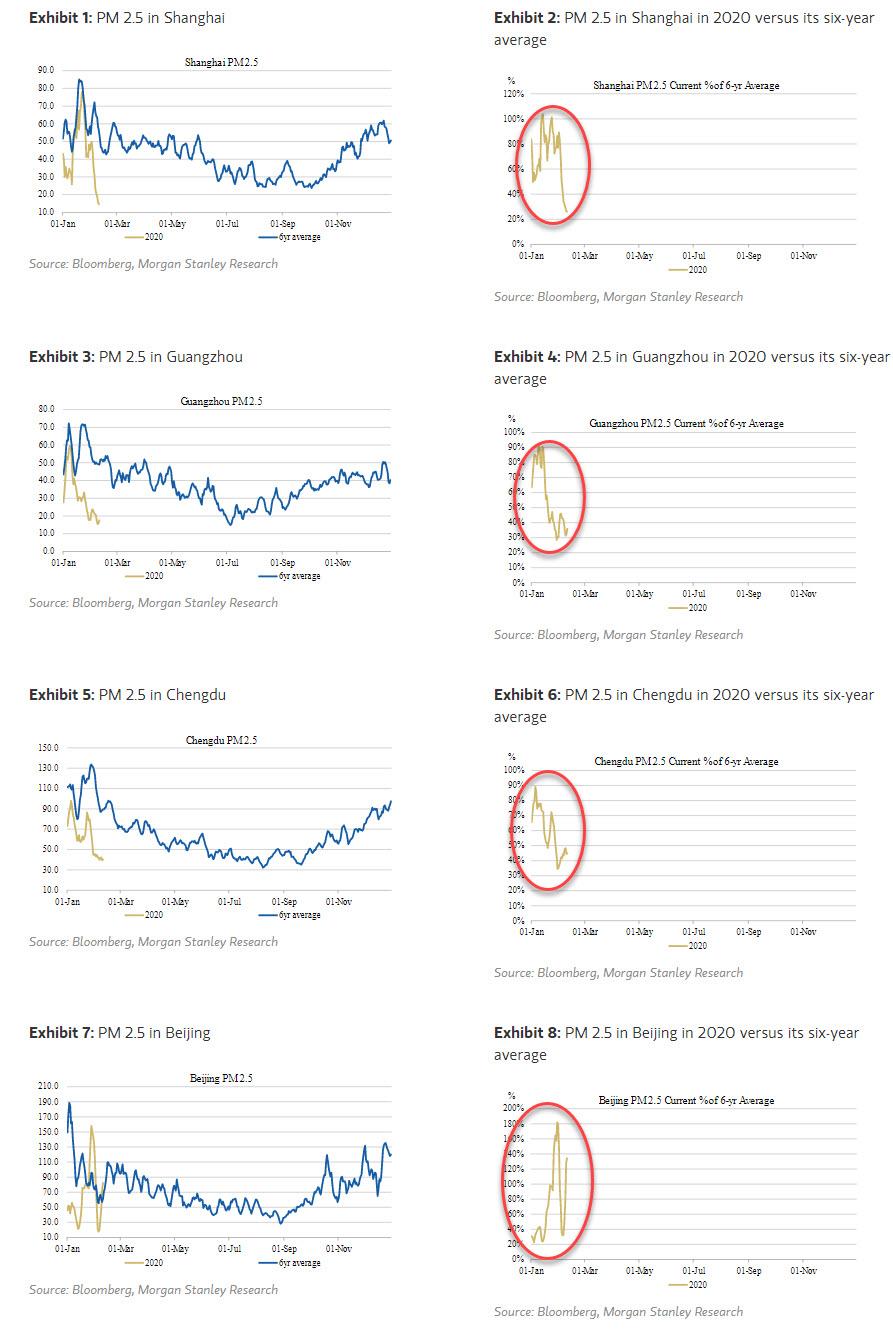

Specifically, Morgan Stanley suggested that real time measurements of Chinese pollution levels would provide a “quick and dirty” (no pun intended) way of observing if any of China’s major metropolises had returned back to normal. What it found was that among some of the top Chinese cities including Guangzhou, Shanghai and Chengdu, a clear pattern was evident – air pollution was only 20-50% of the historical average. As Morgan Stanley concluded, “This could imply that human activities such as traffic and industrial production within/close to those cities are running 50-80% below their potential capacity.”

As a reminder, all this is (or technically, isn’t) taking place as President Xi Jinping on Wednesday sought to send a message that progress had been made in bringing the coronavirus outbreak under control and, for most parts of the country, the focus should be on getting back to business. According to state television, Xi chaired a meeting of the Politburo Standing Committee, China’s supreme political body, on the latest developments on the crisis and future policy responses, concluding that there had been “positive changes” with “positive results”.

Xi also reiterated that all levels of local government and Communist Party committees must strive to achieve China’s social and development goals this year, indicating that he did not want the public health crisis to hinder progress.

Most importantly, Xi urged local authorities to refrain from taking excessive measures to curb contagion, and yet clip after clip from China…

Once upon a time, somebody goes out shopping, and then…

At Tianmen in #Hubei, One of the many scenes in #China during #CoronavirusOutbreak.

湖北天门:从前,有个人,出门买个菜,就回不了家了。 #COVID2019 #Coronavirus #coronaviruschina #武汉肺炎 #武漢肺炎 #新冠肺炎 #新冠病毒 pic.twitter.com/Ji7b4o4Pii— 曾錚 Jennifer Zeng (@jenniferatntd) February 13, 2020

Game over, man. It’s #COVID2019‘s time, not yours.

聚众打麻将犯法。#Coronavirus #CoronavirusOutbreak #coronaviruschina #武汉肺炎 #武漢肺炎 #新冠肺炎 #新冠病毒 pic.twitter.com/r4Lgcjhups— 曾錚 Jennifer Zeng (@jenniferatntd) February 13, 2020

In Xiaogan ,Hubei , young men forced to kneel on the street because they should not go out, one of the many scenes in #China during #CoronavirusOutbreak #COVID19 湖北孝感,出门乱跑当街罚跪。#武汉肺炎 #新冠肺炎 #新冠病毒 pic.twitter.com/FfFzOVp4Cm

— 曾錚 Jennifer Zeng (@jenniferatntd) February 13, 2020

… shows that the measures being taken are far beyond merely “excessive” when it comes to limiting the potential spread of the virus, which probably makes sense considering the unexpected surge in infected cases in Wuhan, which have sent the total for China just shy of 60,000.

Add to this the ongoing uncertainty that Beijing is far behind the curve in containing the virus, and one can see why most businesses are reluctant to “get back to normal.”

In the latest confirmation of just that, several other indicators have emerged showing that despite Xi’s stark demands for 1.4 billion Chinese to ignore the global pandemic which may very well have been started by one of China’s own experimental labs…

“There are plenty of theories out there because Wuhan does have a P4 lab … maybe this was man-made and there’s a theory that this could have been part of a bioweapons program. But that’s just a theory,” says @onlyyoontv on the #coronavirus. pic.twitter.com/1svCAHi0jN

— Squawk Box (@SquawkCNBC) February 13, 2020

… virtually all of China – and all those critical supply chains that keep companies across the globe humming and stocked with critical inventory – remain on lockdown.

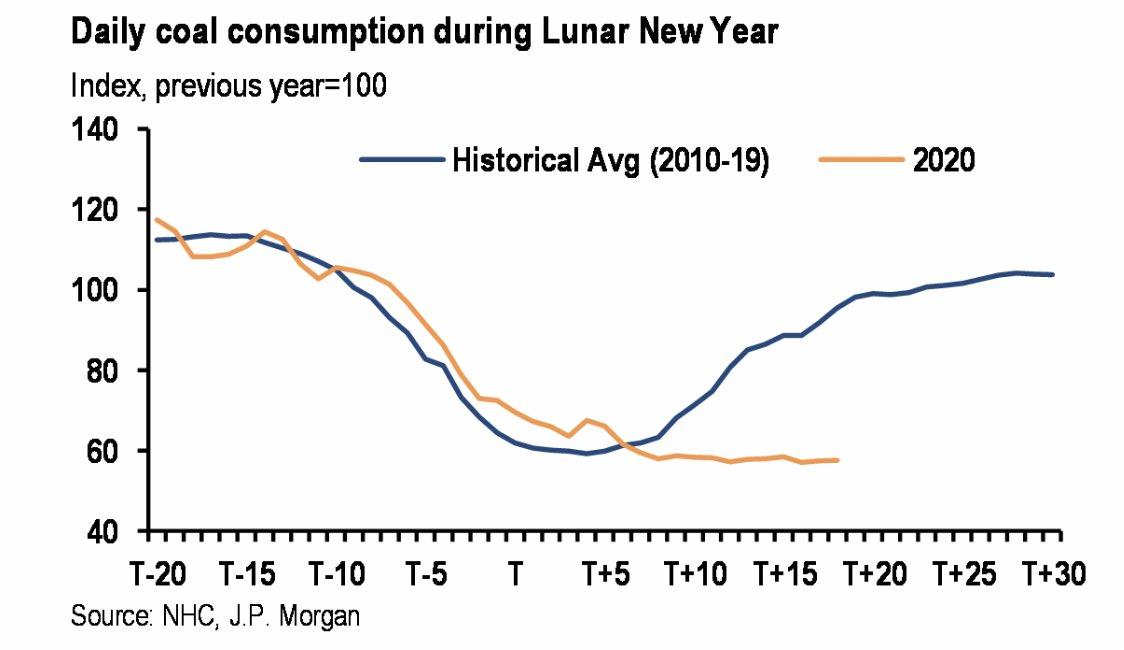

As confirmation, while we wait for an update from Morgan Stanley on the latest Chinese pollution data (at least until Beijing’s definition of “pollution” is also revised) here is JPMorgan showing that while traditionally daily coal consumption – the primary commodity used to keep China electrified – rebounds in the days following the Lunar New Year collapse when China hibernates for one week, this year there hasn’t been even a modest uptick higher, indicating that so far there hasn’t been even a modest uptick in output.

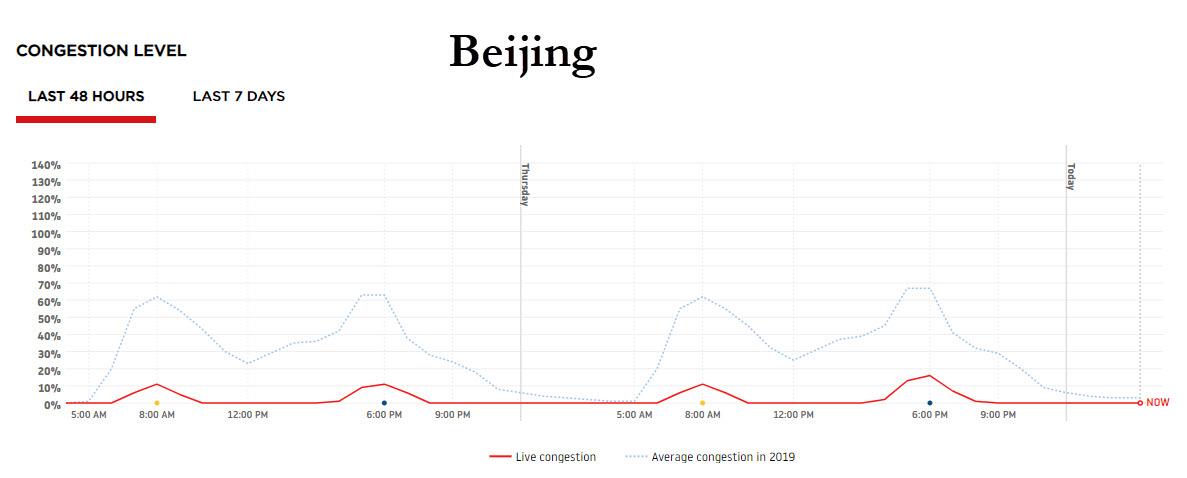

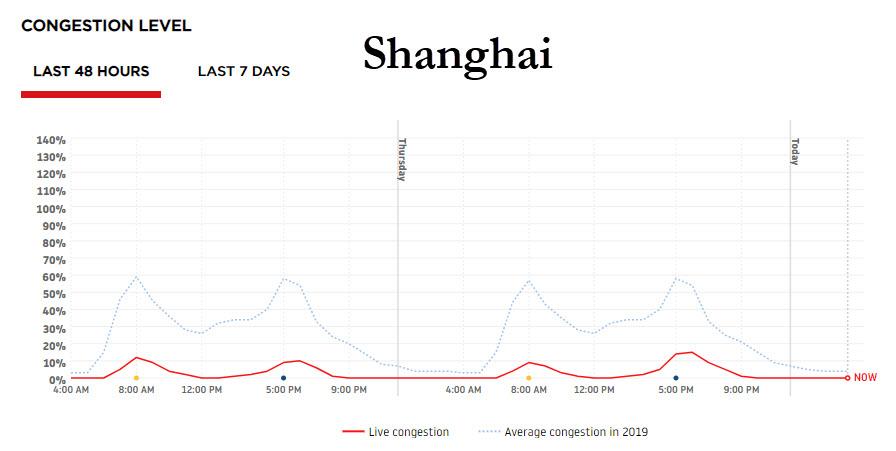

Yet electricity is just one core indicator of real-time economic activity. Perhaps an even more critical one is human transit across the 1.4 billion person strong nation. Conveniently there is a way to track rudimentary traffic patterns across some of China’s key metro areas, and they show that – in a confirmation of the worst-case scenario – activity, as measured by travel, across most of China appears to have ground to a halt.

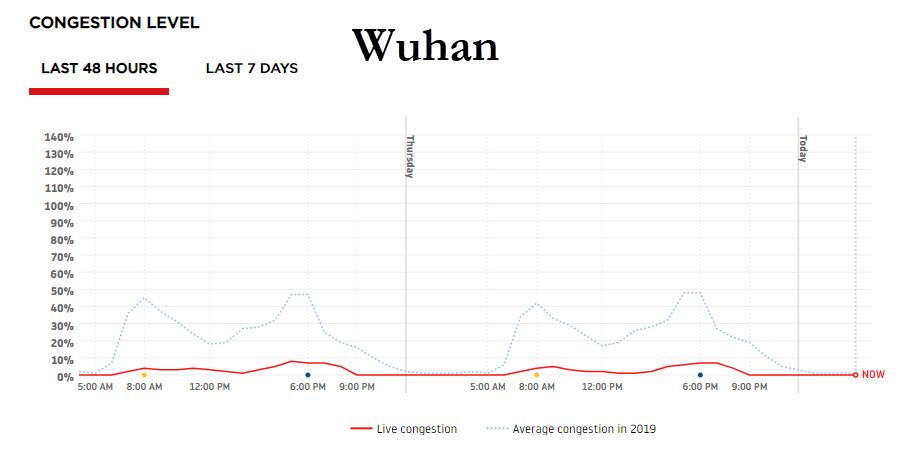

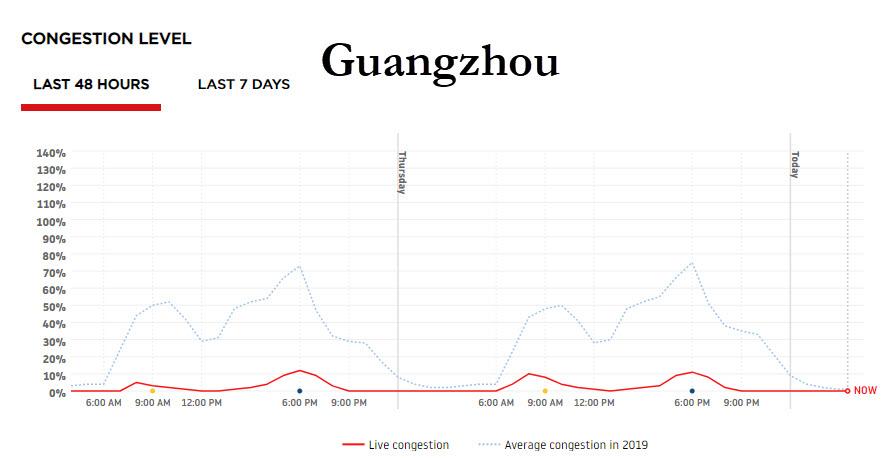

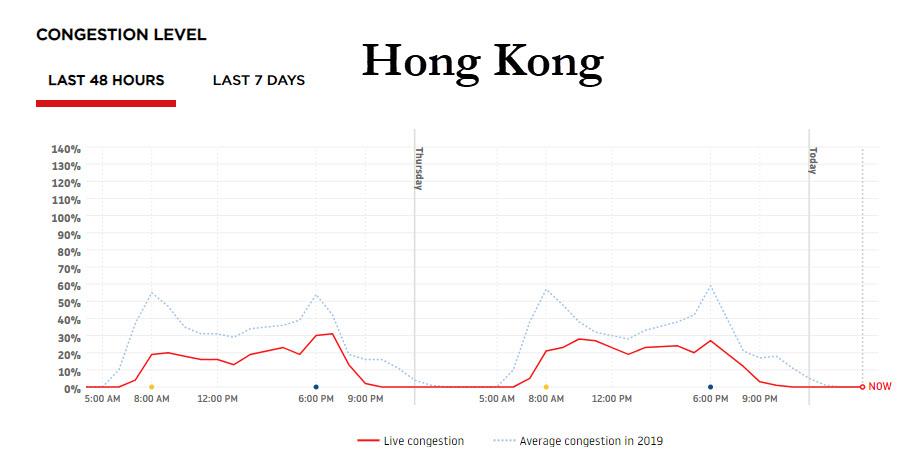

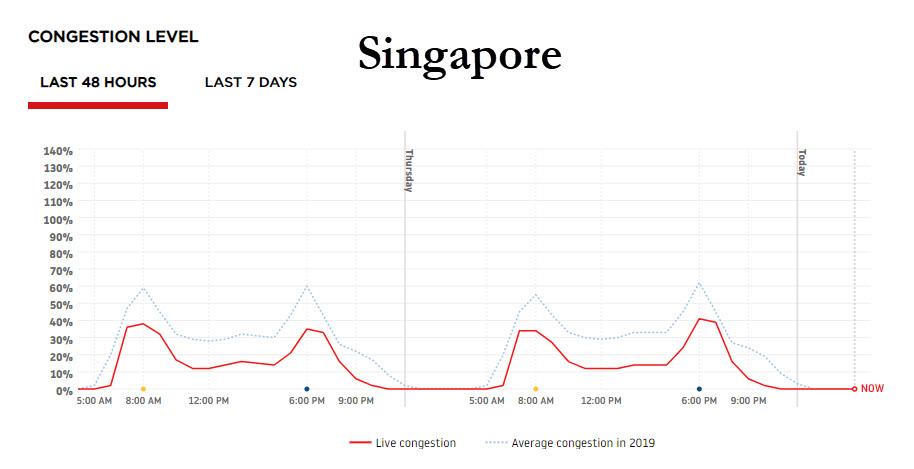

The charts below show TomTom’s traffic congestion data across key Chinese cities such as Beijing, Shanghai and Wuhan as compared to the average measurement for 2019. What they show is that virtually nobody appears to be driving in China!

Here is Beijing’s congestion level over the past 48 hours (a 7 day average is also available) compared to 2019. The data indicates that travel is about 70% below its 2019 peak.

Similarly, Shanghai is about 60% below its peak:

Wuhan, of course, is even worse, with barely any congestion – or traffic – registering.

Amazingly, the industrial hub of Guanghzhou also appears to have ground to a crawl:

And as mainland China grinds to a literal halt, traffic in Hong Kong is also starting to slide…

… and surprisingly, even such major hubs of commerce as Singapore are starting to see a traffic impact.

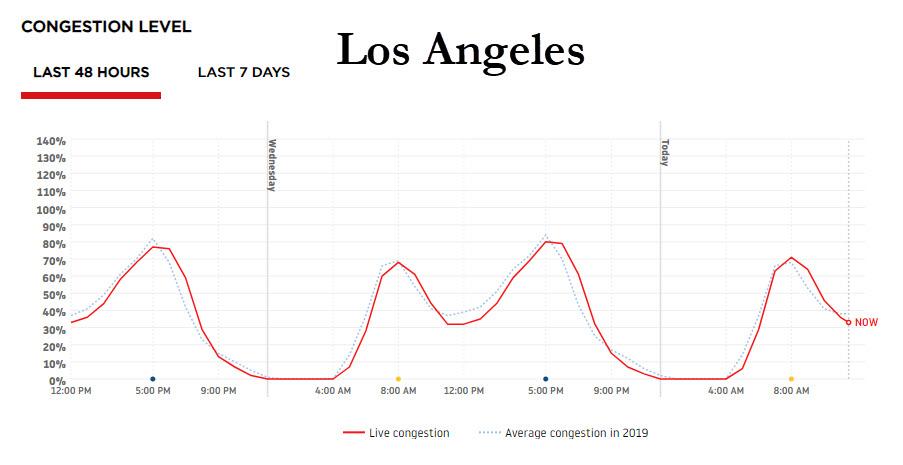

By comparison, here is what Los Angeles traffic looks like over the past 48 hours vs 2019 average.

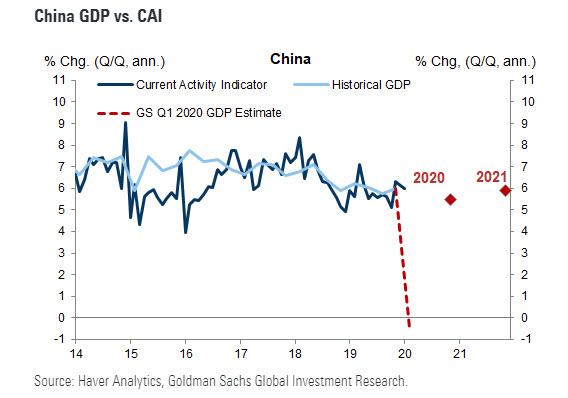

While not perfect, and certainly not a comprehensive view of what is really taking place “on the ground”, the above data is a useful real-time indicator of how the people in China perceive the threat of the coronavirus pandemic, and one thing is abundantly clear: as the pandemic spreads further without containment, and as the charts above flatline, so will China’s economy, which means that while Goldman’s draconian view of what happens to Q1 GDP is spot on, the expectation for a V-shaped recovery in Q2 and onward will vaporize faster than a vial of ultra-biohazardaous viruses in a Wuhan virology lab.