In what may be one of the most bizarre bankruptcy filings, just hours after JCPenney stock was halted first thing in the morning when everyone was certain the company would announce its has filed its Chapter 11 petition only to read in a bizarre 8K that the company had instead made a $17 million interest payment due on its secured term loan during the 5-day grace period, the iconic retail giant (or maybe not so giant any more) and anchor mall tenant threw in the towel after all to what was a long, drawn out and painful period of fading into irrelevance, and just after 6pm announced it had filed for bankruptcy protection in the Southern District of Texas (docket #20-20182).

JCPenney joins a parade of retailers including Neiman Marcus, J.Crew and Stage Stores, who have all filed for bankruptcy this month. Other chains like Gap Inc. and Nordstrom Inc. have recently raised billions of dollars in debt to ensure they have the cash to weather the crisis and reopen stores, although it is unclear if they will survive in a bitter war with off-price chains like T.J. Maxx and e-commerce giants such as Amazon.com Inc

The company, founded by James Cash Penney in 1902, which was once a favorite of middle-class suburban consumers and which operated 846 department stores in 46 states as of Feb 1, had been seeking solutions to address billions of dollars in obligations after revenue evaporated amid government-imposed lockdowns to help stem the Covid-19 pandemic. Store shutdowns since March had choked off JCP’s revenue, putting even more pressure on the company’s massive debt load. After years of falling sales, red ink and failed turnaround efforts, the coronavirus pandemic hastened a reckoning with creditors over its $3.8 billion in debt.

It failed to find a solution, and as a result it filed a prepackaged Chapter 11 restructuring with lenders holding approximately 70% of JCPenney’s first lien debt to reduce the Company’s outstanding debt and strengthen its financial position. From the press release:

The RSA contemplates agreed-upon terms for a pre-arranged financial restructuring plan (the “Plan”) that is expected to reduce several billion dollars of indebtedness, provide increased financial flexibility to help navigate through the Coronavirus (COVID-19) pandemic, and better position JCPenney for the long-term. To implement the Plan, the Company today filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas, in Corpus Christi, TX (the “Court”).

As part of the bankruptcy, JCP arranged a $900 million DIP loan which includes $450 million of fresh capital. It had been in discussions with some of its largest lenders, including Sixth Street Partners and KKR, Apollo Global and Ares Management, as well as H/2 Capital Partners, who will end up owning the post-reorg equity.

The financing, combined with cash flow generated by the Company’s ongoing operations, is expected to be sufficient to meet JCPenney’s operational and restructuring needs. As part of the DIP commitment from its existing lenders, “JCPenney will explore additional opportunities to maximize value, including a third-party sale process.”

JCPenney will also reduce its store footprint “to better align its business with the current operating environment. Stores will close in phases throughout the Chapter 11 process – and the first phase of closures, including specific store details and timing, will be disclosed in the coming weeks.”

Kirkland & Ellis LLP is serving as legal advisor, Lazard is serving as financial advisor, and AlixPartners LLP is serving as restructuring advisor to the Company.

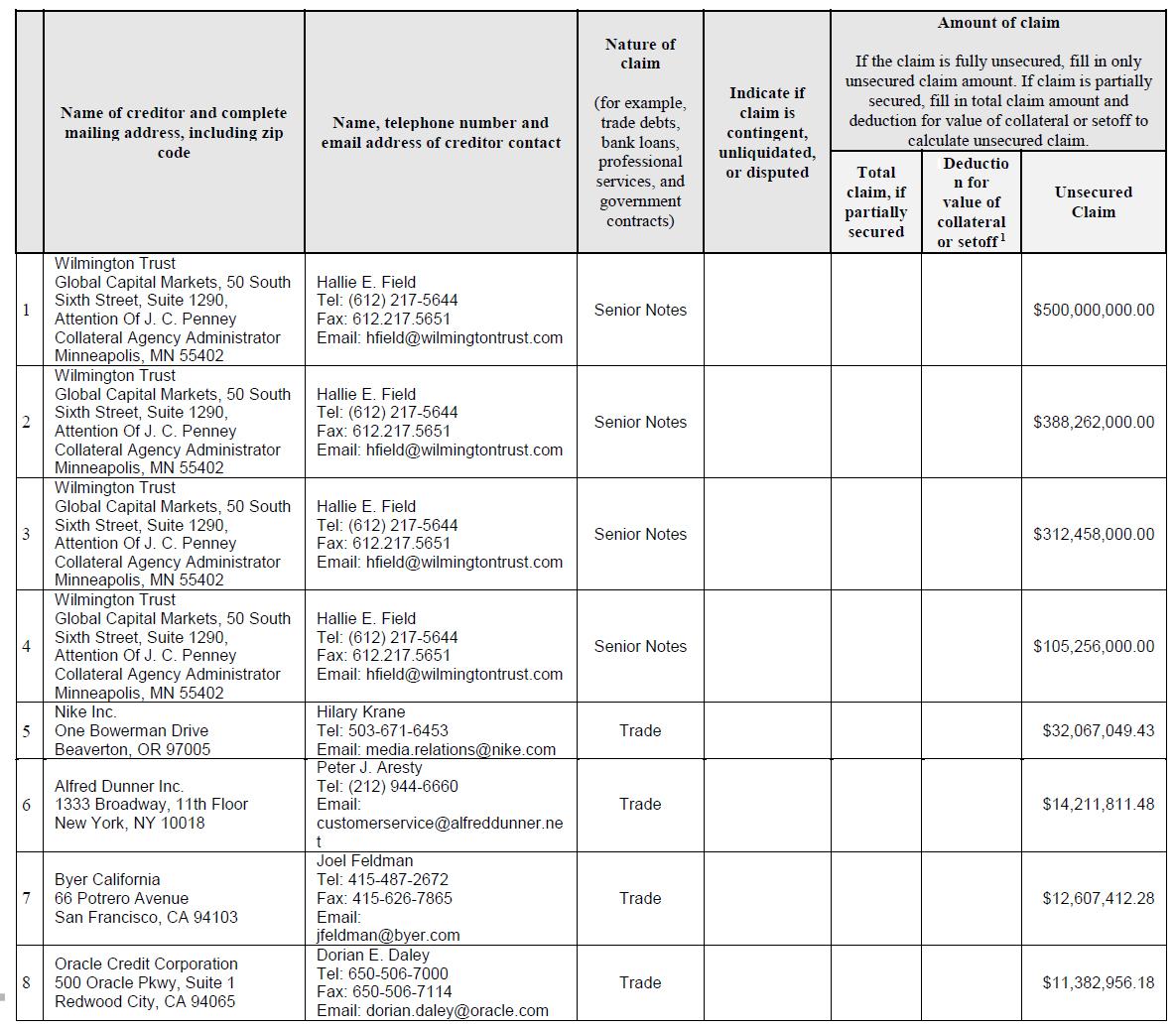

The company listed between $1 and $10 billion in estimated assets, the same range of estimate liabilities, and over 100,000 creditors, most of whom are small vendors who hold trade claims against the company and will now have to get in line to get paid at some point in the coming months. In addition to the company’s bondholders, among the biggest trade creditors are Nike, Alfred Dunner and Byer California, with $32MM, $14MM and $12.6MM in claims, respectively.

Penney’s sales, which totaled $10.7 billion in the most recent fiscal year, have fallen each year since 2015, and it hasn’t made an annual profit in nearly a decade. The company skipped two interest payments in recent weeks, setting the clock on a bankruptcy filing.

Department stores have hammered not only by the secular changes in the . Stage Stores, which operates the Gordmans, Bealls and Goody’s chains in mostly rural towns, is liquidating hundreds of stores when they reopen this month and looking for a buyer. Both Macy’s Inc. and Nordstrom are closing some of their flagship stores.

Over the past decade, the company had been trying to attract younger shoppers, but it gave up on that goal to focus on winning back middle-aged moms. “They lost their core customer, and they have never been able to get her back,” said Chuck Grom, an analyst with Gordon Haskett Research Advisors. Jill Soltau, who has been CEO since 2018, refocused on apparel and launched a test store in Texas with a fitness studio and videogame lounge.

Like its formerly largest rival Sears, JCP was for decades a one-stop shop for millions of middle-class families, offering clothes, appliances, gardening equipment, portrait studios and beauty salons. At one point, the WSJ reminds us, it owned a bank and the Eckerd drugstore chain. It was once fixture in American shopping malls and at its peak in the 1970s operated more than 1,600 stores; in a few years nobody will remember the name once all of its big box outlets are either converted into laser tag arcades or are acquired by Amazon.

With JCPenney’s most liquid bonds trading at roughly 6 cents on the dollar Friday morning, the bankruptcy filling has been fully priced in.

The full bankruptcy filing is below: