Authored by Charles Hugh Smith via OfTwoMinds blog,

As the old models break down, opportunities for new models will arise.

Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability.

That’s the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence.

But sadly for the status quo, all bubbles pop, all extremes revert to the mean and all that is unsustainable implodes as apparently linear systems (snow accumulating on a mountainside) suddenly go non-linear (avalanche).

The majority of the Pre-Pandemic Bubble Economy was unsustainable:

1. Bubbles in the stock market and housing– unsustainable

2. Soaring debt: corporate, household and public– unsustainable

3. College costs paid by trillions of dollars in student loan debt– unsustainable

4. Healthcare consuming 20% of the GDP– unsustainable

5. Bubble in commercial real estate (CRE) — unsustainable

6. Long supply chains to Asia– unsustainable

7. Fracking industry dependent on ever-expanding debt to fund operations– unsustainable

8. Over-supply and over-capacity for almost everything– unsustainable

I could go on but you get the idea.

As I’ve been discussing in recent months, these unsustainable systems are tightly bound and incredibly fragile. Each is a row of dominoes that intersect with all the other rows, so one domino falling in any row will topple all the dominoes in every row.

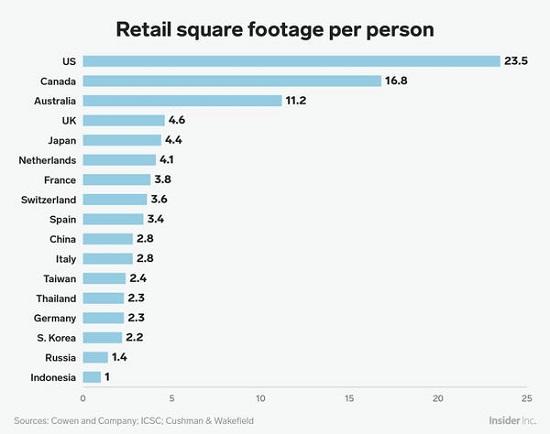

Consider just one unsustainable sector: commercial real estate. Thanks to decades of overbuilding caused by the Federal Reserve’s super-low interest rates, there is too much commercial space in the U.S.: too much retail space, too much office space, too much self-storage, etc. There are also too many new buildings on soon-to-be empty college campuses and too many hotels, etc.

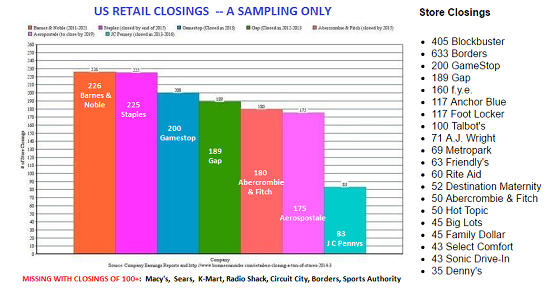

The decimation of retailers has been underway for the past four years. The chart below is from 2017, and the store closures have only accelerated.

The U.S. has between 8 and 10 times more retail space than other developed economies. That suggests 50% or more of all the commercial retail space in America is superfluous.

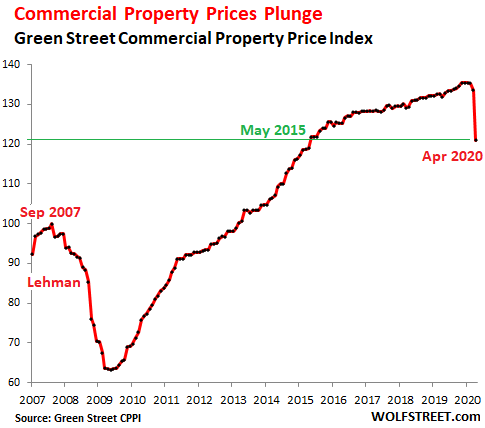

The demand for commercial space is crashing, and nose-bleed valuations are under pressure. This charts shows that valuations could fall in half–and that wouldn’t necessarily rebalance supply and demand.

Source: US Commercial Real Estate Prices Plunged in April, Mall Prices Collapsed

All the trillions of dollars in debt piled on over-valued CRE is at risk of default. That alone will trigger a widening financial crisis as the dominoes fall.

As Richard Bonugli and I discuss in our recent podcast on “the new normal,” as the old models break down opportunities for new models will arise. For example, the entire education complex based on the outdated, dysfunctional “factory model” of large campuses and hundreds or thousands of students packed together is ripe for disruption.

Why not have small decentralized classes without the bloated administration and centralized curriculum–not to mention the improved security of small, decentralized groups? In my book The Nearly Free University I describe how small, decentralized “apprenticeship” groups could improve actual learning while eliminating the entire bloated administration and campus costs (lab work could be performed onsite in existing work places).

Rather than accredit the institution, accredit the student.

The unsustainably costly healthcare sector is equally ripe for disruption as demand destruction and soaring costs undermine the current model of profiteering.

Decentralizing the economy sacrifices the long global supply chains and corporate monopolies for local jobs and local supply chains. All the corporate and state monopolies and cartels that have hollowed out the economy and the social order were exploitive, parasitic and predatory as well as unsustainable, and their slide into the dustbin of history is accelerating as linear systems cascade into non-linear dynamics.

The post-Covid economy will be very different from the pre-pandemic bubble economy, in ways few anticipate: non-linear creative destruction and DeGrowth will be the dominant dynamics. Models that obsolete the old, unsustainable, dysfunctional models will blossom, and that is how civilization advances.

Maybe “shareholder value” has been the greatest con in history, a PR cover story for the greatest rise in wealth and power inequality in American history.