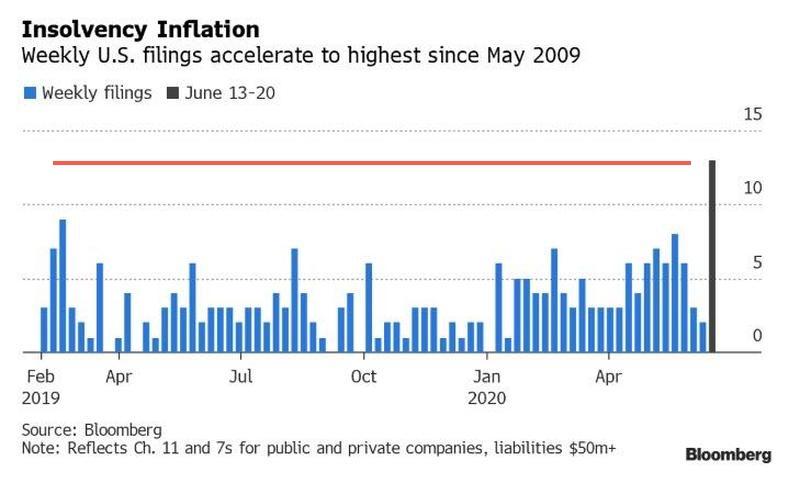

On Tuesday, we noted that weekly bankruptcies are soaring, the most in over a decade, and there is a striking correlation between the unemployment rate and chapter 11 filings. Not too long ago, we said that a “biblical” wave of bankruptcies is about to flood the U.S. economy.

With that being said, and at no surprise, GNC Holdings, Inc. filed for bankruptcy protection on Tuesday night, intending to sell its business and shutter over 1,000 stores.

The health and wellness brand, based in Pittsburgh and founded in 1935, “expects the Chapter 11 process will benefit its stakeholders and best position the Company for long-term success.” The Chapter 11 petition was filed in U.S. Bankruptcy Court in Delaware will allow the company “to restructure its balance sheet and accelerate its business strategy.”

GNC said it reached a deal with its secured lenders for approximately $130 million in additional liquidity to continue operations through the bankruptcy process and work toward a prearranged reorganization plan with creditors.

“GNC has secured approximately $130 million in additional liquidity through (i) a commitment from certain of its term lenders to provide $100 million in “new money” debtor-in-possession (DIP) financing and (ii) approximately $30 million to come from certain modifications to the existing ABL credit agreement,” GNC said.

The company said it “reached an agreement in principle for the sale of the Company’s business” – with the starting bid price of $760 million, subject to court approval.

“With the support of its lenders and key stakeholders, the company expects to confirm a standalone plan of reorganization or consummate a sale that will enable the business to exit from this process in the fall of this year,” GNC said.

GNC estimated its total debts at $895 million and total assets of $1.4 billion. The company plans to close 800 to 1,200 of its 5,200 retail locations throughout the U.S.

“This acceleration will allow GNC to invest in the appropriate areas to evolve for the future, better positioning the company to meet current and future consumer demand around the world,” GNC said in a statement.

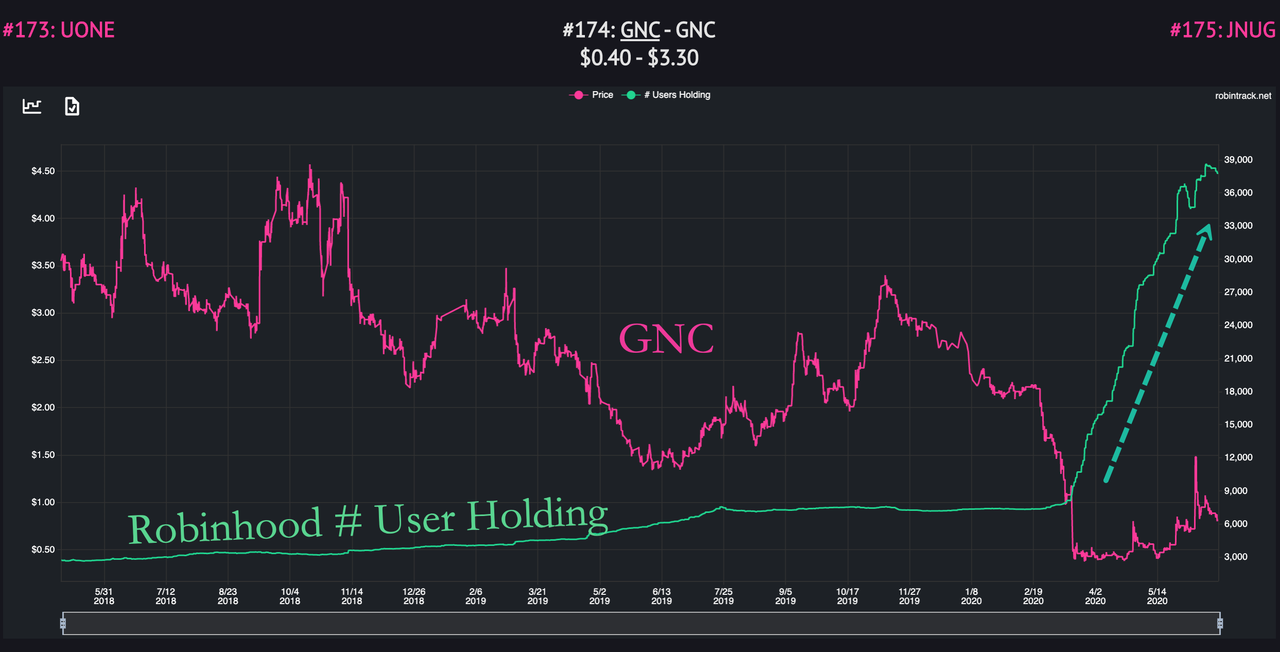

Robinhood pajama daytraders panic buying, yet, another bankrupted company…

The retail industry’s temporary shutdown of stores to mitigate the spread of the virus has been absolutely catastrophic – the ripple effect has led to some retailers not paying rent, which has pressured real estate companies. Several large mall operators are under severe financial distress thanks to retail tenants skipping out on rent payments:

- Default By Mall-Owner CBL Sparks Another Manic-Bid By Robinhood Daytraders

- Mall Giant Demands Rent Payments Even As It Skips Its Own

Ultimately, GNC will not be alone – many other retail outlets will be forced to file for bankruptcy this year, resulting in far more pain for commercial real estate companies. So for all the talk of a V-shaped economic recovery – well it’s just nonsense.