Earlier this week when we reported that JPMorgan has quietly halted all non-Paycheck Protection Program based loan issuance for the foreseeable future, we said that we didn’t buy the stated reason namely – the bank was drowning in (government-backstopped) applications and would be willing to forego millions in easy, recurring net interest income and that instead the real reason why JPMorgan would “temporarily suspend” all non-government backstopped loans such as PPP, is if the bank expects a default tsunami to hit, coupled with a full-blown depression that wipes out the value of assets pledged to collateralize the loans. We went on:

Furthermore, why issue loans that will default in months if not weeks, just as bankruptcy courts fill up with millions of cases (assuming the coronavirus clears out by then, as the alternative is simply unthinkable – a default tsunami without any functioning Chapter 11 or Chapter 7 process) when JPM can simply stick to the 100% risk-free issuance of government-guaranteed small-business loans which pay a handsome 1% interest, especially if it makes JPM look patriotic by doing its duty to bail out America.

Over the weekend our skepticism was confirmed when Reuters reported that JPMorgan, the country’s largest lender by assets and which will kick off earnings season tomorrow, will raise borrowing standards this week for most new home loans as the bank “moves to mitigate lending risk stemming from the novel coronavirus disruption.”

Starting Tuesday, customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home’s value (something which we thought was the norm after the last financial crisis, but apparently lending conditions had eased quite a bit in the past decade).

“Due to the economic uncertainty, we are making temporary changes that will allow us to more closely focus on serving our existing customers,” Amy Bonitatibus, chief marketing officer for JPMorgan Chase’s home lending business, told Reuters.

According to Reuters, “the change highlights how banks are quickly shifting gears to respond to the darkening U.S. economic outlook and stress in the housing market, after measures to contain the virus put 16 million people out of work and plunged the country into recession.”

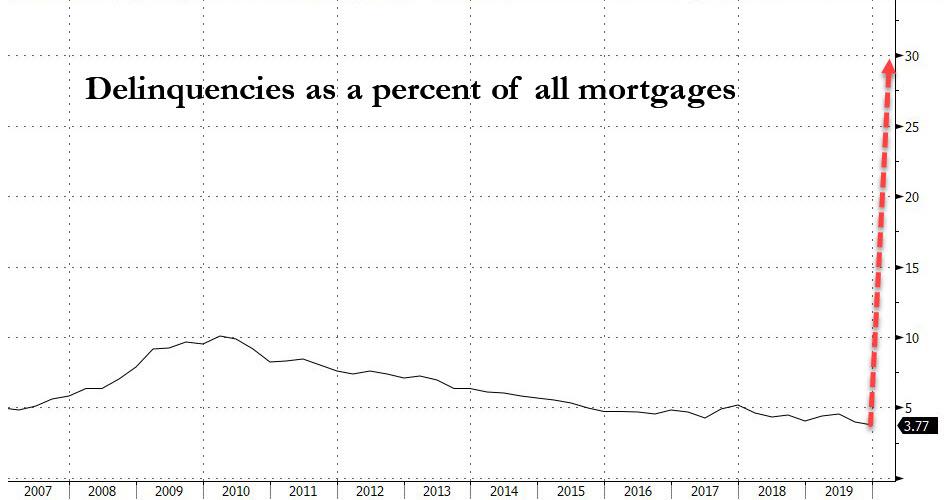

What the change really highlights is that after halting its exposure to plain vanilla, non-government guaranteed loans, JPMorgan is now quietly pulling out of that other market where it makes the bulk of its revenues – mortgages – ahead of a tsunami of mortgage defaults, which last week we dubbed “The Next Crisis” as “Up To 30% Of All Mortgages Will Default In “Biggest Wave Of Delinquencies In History.”

Sure enough, JPMorgan – the fourth largest U.S. mortgage lender in 2019 – not only agrees with this dour assessment, but is taking proactive measures to mitigate its exposure to this wave of defaults but minimizing its exposure as soon as it can. And with JPM setting the stage, it is only a matter of days before all other banks follow and lock out tens of million of even credit-worthy Americans with less than prime credit scores, out of the housing market for years.

Of course, just like in the PPP case, the bank did not dwell on the true cause for this action, but instead said the change will “free up staff to handle a surge in mortgage refinance requests, which are taking longer to process due to staff working from home and non-essential businesses being closed.” While that is certainly a factor, the biggest reason behind these changes is to help JPMorgan reduce its exposure to borrowers who unexpectedly lose their job, suffer a decline in wages, or whose homes lose value.

In short, JPMorgan wants no part of the shitstorm that is about to be unleashed on middle America.

While JPMorgan would not disclose the current minimum requirements for its various mortgage products, the average down payment across the housing market is around 10%, according to the MBA. Furthermore, the new credit standards do not apply to JPMorgan’s roughly four million existing mortgage customers, or to low and moderate income borrowers who qualify for its “DreaMaker” product, which requires a minimum 3% down payment and 620 credit score.

The U.S. housing market had been on a steady footing earlier this year, but all hell broke loose as a result of the economic paralysis and deepening depression resulting from the Coronavirus pandemic. And with would-be home buyers unable to view properties or close purchases due to social distancing measures, the health crisis now threatens to derail the sector, especially as banks are going to make it next to impossible to get a new mortgage.

To be sure, as we reported last week the residential mortgage market is already freefalling after borrower requests to delay mortgage payments exploded by 1,896% in the second half of March. And unfortunately, this is just the beginning: last week, Moody’s Analytics predicted that as much as 30% of homeowners – about 15 million households – could stop paying their mortgages if the U.S. economy remains closed through the summer or beyond. Bloomberg called this the “biggest wave of delinquencies in history.”

This would result in a housing market depression and would lead to tens of billions in losses for mortgage servicers and originators such as JPMorgan.