The Fed is now in very serious trouble.

Over the weekend the Fed announced another emergency rate cut, this time of 1%. This brings rates back down to zero.

The Fed also announced a $700 billion QE program, including $200 billion of mortgage backed securities and $500 billion of Treasuries.

And the futures market collapsed… LIMIT DOWN. As I write this, the stock market will be opening down some 5%.

Put another way, the Fed has gone truly NUCLEAR with monetary policy… and the market is STILL imploding.

In the last two weeks, the Fed has:

1) Cut rates from 1.25% to ZERO.

2) Launched a $1.5 TRILLION repo program.

3) Launched a $700 billion QE program.

And NONE of these items has stopped the market collapse.

So, what is going on?!?!

The Fed is facing the perfect storm of crises.

The Fed faces an:

1) An economic recession possibly a depression triggered by a pandemic.

2) A corporate debt crisis with some $4-$5 trillion in debt at risk.

Regarding #1, the coronavirus pandemic has resulted in the global economy stopping. The latest numbers out of China show DEPRESSION-like collapses in economic activity.

The U.S. is heading there now. Restaurant traffic is down some 30%+ in the last week (60% in some markets). Events are being canceled. And people are staying home rather than going out and spending money.

The Fed can do NOTHING to stop this. No amount of rate cuts of stimulus from the Fed will make people want to go out and spend money if the country is on lockdown/ facing a health crisis triggered by a pandemic.

This in turn is triggering #2: a corporate debt crisis with some $4-$5 trillion in debt at risk.

Since 2008, US corporations have issued a truly INSANE amount of debt, often times using this debt to buy back their own stock.

Consider that it took 50 years for the US corporate bond market to hit $4 trillion. It has more than DOUBLED that to $10 trillion since 2008 alone.

The economic impact of the coronavirus has brought this market under systemic duress. With corporate sales imploding, companies will suddenly have much less money to use to make debt payments.

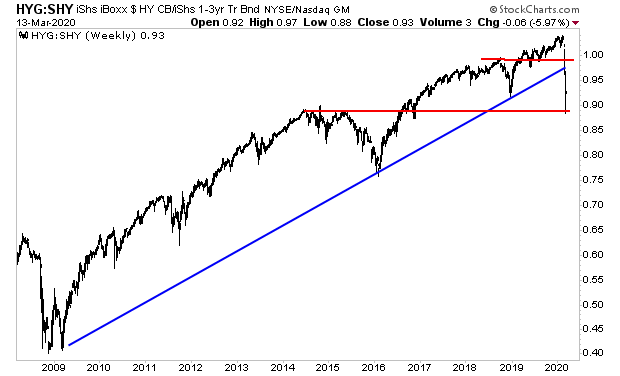

As you can see in the chart below, the bull market in junk bonds is OVER. If we take out that lower red line, we’re entering a systemic crisis for corporate debt.

This is a huge deal. And frankly, the Fed can’t do anything about it.

The corporate debt market is a $10 trillion bubble, of which $1.5 trillion is junk (think subprime) and another $4 trillion is just one step above this (probably junk as well).

And unlike mortgages or Treasuries, the Fed CANNOT buy this stuff. Not unless congress changes the Federal Reserve act.

Why does this matter?

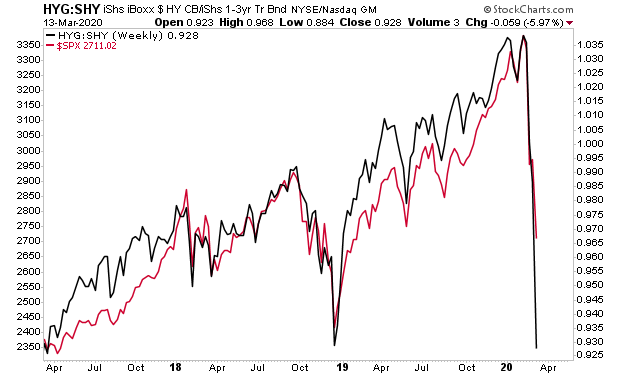

Because corporate debt leads stocks. The stock market bounced at 2,500. Credit tells us stocks will be heading to 2,300 if not lower.

In the simplest of terms, the next crisis is here. The coronavirus has burst the Everything Bubble. And we’re heading into another 2008 type meltdown, or possibly something worse.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market StrategistParagraph

Phoenix Capital Research