Authored by Sturart Barnes via OilPrice.com,

Various reports hit the news feeds today quoting a deliberately headline-grabbing statement by Paul Sankey, managing director at Mizuho Securities, in which he is reported as saying, “Oil prices can go negative.” That is, they could as a combination of Saudi Arabia (and Russia) flooding the market with increased oil and the market running headlong into COVID-19-induced curtailment of activity that is suppressing consumption, which combined will create the perfect storm of excess supply.

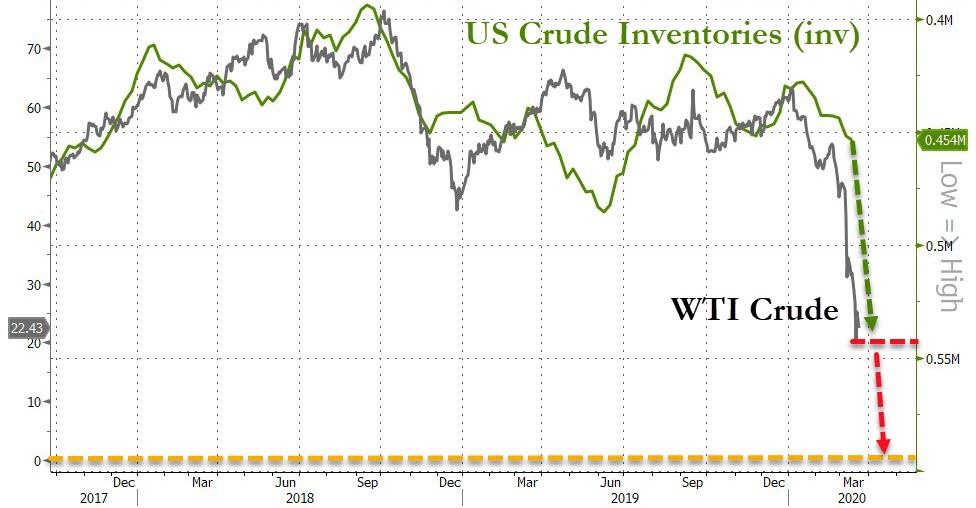

In reality, inventory levels are already rising.

CNN quotes Sankey, who said global oil demand is only around 100 million barrels per day.

However, the economic fallout from the coronavirus pandemic could crash demand by up to 20 percent.

This would create a 20 million barrel-per-day surplus of oil in the market that would rapidly exceed storage capacity, forcing oil producers to pay customers to buy the commodity – hence, in effect, negative oil prices.

[ZH: Think that’s crazy? Think again… as we detailed previously, NatGas prices went negative in 2018]

The American government plans to purchase a total of 77 million barrels of oil starting within weeks the article states, but according to Sankey, this can only be done at a rate of 2 million barrels per day, leaving a massive excess that will be looking for a home.

Brent oil prices have already fallen to the lowest level for 17 years. The consequences for the U.S. oil industry if a coronavirus-induced recession drives down demand could be catastrophic.

West Texas Intermediate crude (WTI) collapsed by a staggering 19.2 percent to $22 while the Mexican Basket is down 22.4 percent.

For a short while, hedges will protect producers and they will continue to pump oil. While that will protect producers for a while, it encourages counter-cyclical practices; producers should be cutting back but instead will probably continue to pump and ship into store.

Francisco Blanch, a commodity strategist at Bank of America, warns in a Fox Business report that the demand destruction caused by the COVID-19 virus and the price war between Saudi Arabia and Russia could cause inventories to swell by 900 million barrels in the second quarter alone. He estimates the world currently has about 1.5 billion barrels of available storage.

Storage, however, is regional and may not match neatly with excess supply.

China continues to build storage capacity, having traditionally been short of space, but is now in a better position to take advantage of ultra-low prices.

“In a severe scenario, if the market struggles to find a home for surplus barrels, then oil prices might have to trade down into the teens,” Blanch suggests.

That would leave U.S. and Canadian producers deeply in the red when hedges run out. Weaker OPEC countries, like Iraq, Iran, Venezuela, and Nigeria, could see their economies collapse, while all offshore production would be loss-making if oil prices remain suppressed into the teens over the long term.

Having laid out the worst-case scenarios, it should be said even Saudi Arabia and Russia will burn through their reserves at a clip if prices fall into the teens. As such, some form of truce, one that would support prices and reduce output, is possible.

In addition, our focus has naturally been on the direst of outcomes from the current pandemic: a combination of short, sharp lockdown shock and the acceleration of new vaccines could see us in a much more optimistic situation two months from now.

A recession? Yes, inevitably, but for how long? The first half of the year, maybe, before some form of stability reasserts itself.

Still, who can blame them? “Negative oil” has a ring to it.

Just don’t expect to get a credit to your card when you fill up your tank — it ain’t going to happen.