With 17 million Americans out of work in under three weeks, consumer sentiment crashing the fastest on record, and the economy sliding into a depression, households are starting to crack.

The evidence of the “working poor” crushed by the economic downturn is starting to be realized with huge runs on food bank systems across the country. On Thursday alone, the San Antonio Food Bank, located in San Antonio, Texas, aided about 10,000 households with food.

Does this remind you of the great depression?

To confirm our thoughts that the evolution of the virus crisis has morphed into a financial crisis, now a social crisis. We turn to a recently published study via the career advice site Zety.com has confirmed what we’ve been saying for years: Households don’t have the financial cushion to weather an economic storm.

The study polled about 1,000 working Americans last month, asking them about their financial well-being.

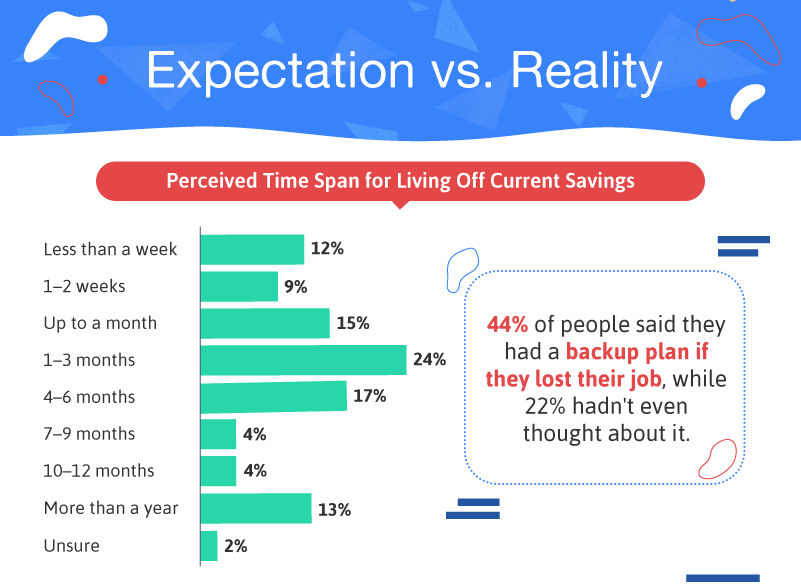

In the first series of questions, respondents were asked about how long their savings could bridge them if they lost their jobs. Shockingly, 36% answered 0-1 month, 24% answered 1-3 months, and so forth. That means at least 60% of respondents had only enough savings for less than three months, and judging by today’s lockdowns, we could extrapolate those numbers and conclude that many people might not survive the economic downturn currently underway, despite government UBI checks.

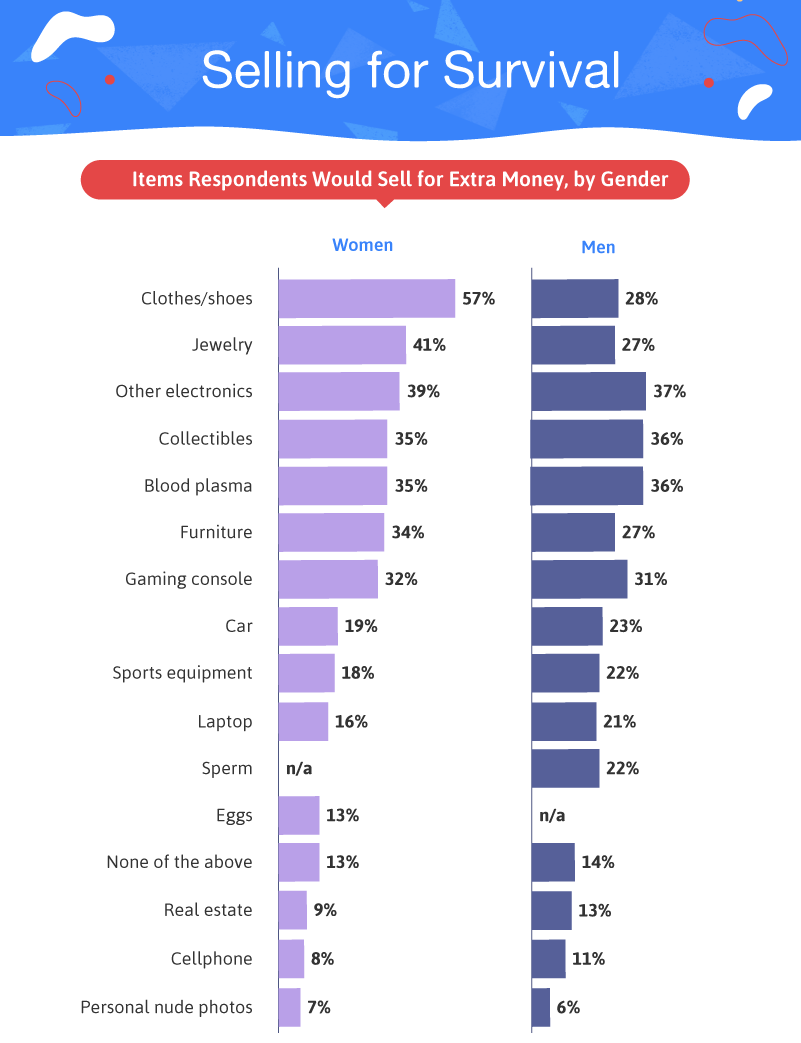

With financial conditions of households quickly deteriorating, their savings are limited, have insurmountable debts, and mounting expenses could force some into liquidating assets to build cash.

The survey had this to say:

“Women were more likely than men to sell certain items for extra money, including their clothing and shoes (57%) and jewelry (41%). In contrast, men were slightly more willing to part with their laptop (21%), collectibles (36%), blood plasma (36%), car (23%), and sports equipment (22%).”

You read that correctly, more than a third of Americans who are in a financial bind are willing to sell their blood to make an extra few dollars to cover rent payments, service bills, and even maybe use the money to cover student loan payments. However, the government has unveiled new economic hardship deferment plans for working-class poor that could alleviate some short-term stress.

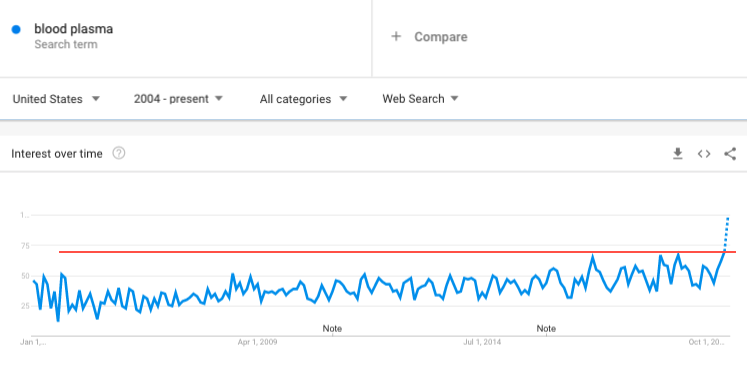

As calls for blood plasma donations are increasing due to the pandemic, search term “blood plasma” has hit a new record high. Maybe the working-class poor can sell their blood for cash to put food on their tables.

The survey was published in the third week of March, and at that time, about 43% of all respondents were “somewhat worried” about a recession. That figure has likely jumped to near 100% today.

Before the depression, millennials were already selling their blood to fund “shopping addictions” and travel. Now it appears people could be heading to blood plasma facilities to fund their rent payments and put food on the table. It seems the good times are over for tens of millions of Americans, as the Great Depression 2.0 unfolds.